| | | | | | |

OUR VISIONo | | | | OUR VALUESPreliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material under §240.14a-12 |

Raymond James Financial, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | | | | |

| x | | No fee required |

| o | | Fee paid previously with preliminary materials |

| o | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Who We Are

| | | | | |

OUR VISION Our vision is to be a financial services firm as unique as the peoplewe serve,, transforming lives, businesses and communities through the power of personal relationships and professional advice. | OUR MISSION Our business is people and their financial well-being. We are committed to helping individuals, corporations and institutions achieve their unique goals, while also developing and supporting successful professionals, and helping our communities prosper. |

| |

OUR VALUES

| |

| | | | | | | | | |

| | | |

If we do what’s right for our clients, the firm will do well and we’ll all benefit. |

| | |

| | We put others above self, and what’s right above what’s easy. We believe doing well and doing good aren’t mutually exclusive.

|

| | | |

OUR MISSION

Our business is peopleand their financial well-being.

We are committed to helping individuals, corporations and institutions achieve their unique goals, while also developing and supporting successful professionals, and helping our communities prosper.

| | | |  | | We respect autonomy, celebrate individuality and welcome diverse perspectives, while encouraging collaboration and innovation.

|

| | |

| | We act responsibly, taking a conservative approach that translates into a strong, stable firm for clients, advisors, associates and shareholders.

|

RAYMOND JAMES 2022 PROXY STATEMENT

RAYMOND JAMES FINANCIAL, INC.

880 Carillon Parkway

St. Petersburg, Florida 33716

(727)

Letters from Leadership

I am pleased to invite you to our

20222023 Annual Meeting of

Shareholders.Despite ongoing challenges due toShareholders, which will be held virtually, via webcast, on February 23, 2023, at 4:30 p.m. Eastern Standard Time (EST).

Notwithstanding the

COVID-19 pandemic,challenging and volatile market environment, Raymond James

once again achieved

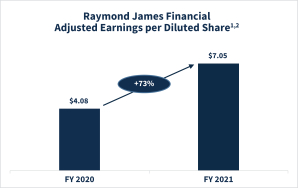

strongrecord financial results in fiscal

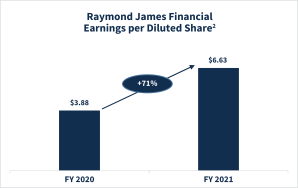

2021. Due in large part2022, with annual net revenues of $11 billion and net income available to

our diverse yet complementary businesses, we finished the year withcommon shareholders of $1.5 billion, driven by record net revenues

of $9.76 billionin the Private Client Group, Asset Management and Bank segments and record

netpre-tax income

of $1.40 billion. Continuing our well-established track record of retention and recruiting of financial advisors, we reached record numbers of both financial advisors and client assets of $1.18 trillion. Meanwhile, our investment banking success in

both M&A and underwriting, and a record year for fixed income brokerage revenues due to high levels of client activity, helped us achieve record revenues in our Capital Markets segment. Demonstrating our commitment to deploying excess capital, we completed three acquisitions during the

year and announcedPrivate Client Group. These strong results highlight the

intention to acquire two additional firms. We believe these acquisitions satisfy our longstanding criteria of being a strong cultural fit, having a good strategic purpose and making financial sense for our shareholders.Moving forward, we are well-positioned with robust capital ratios and records for allresilience of our key business metrics. Additionally, activity levels for financial advisor recruiting, investment bankingmodel and fixed income brokerage remain strong. However, we also understand there are uncertainties, includingreinforce the pacevalue of recovery from the initial shutdowns related to COVID-19, the continued effects of the pandemic,our diverse and U.S. economic policy. Whatever potential challenges lie ahead, we believe our capital and liquidity provide balance sheet flexibility to not only withstand them but also to be opportunistic in these environments.

I would be remiss not to note that Francis S. “Bo” Godbold, who has served on our Board of Directors since 1977, will not be re-nominated for election at the 2022 Annual Meeting of Shareholders. One of Chairman Emeritus Tom James’ earliest recruits in 1969, Bo’s intellect and leadership have been instrumental to the growth and success of the firm. Like all public companies, we are facing growing pressure from proxy advisors urging greater formal independence for public company boards, and Bo has been viewed as an insider for these purposes despite his independent industry expertise and resolute shareholder advocacy. He has had a remarkable career, with professional achievements and community service recognitions far too long to list. He will continue to serve on the Raymond James Bank Board of Directors, but I speak for the entire Raymond James Financial Board of Directors in saying that his contributions and counsel will be greatly missed.

Once again this year, we have determined that our Annual Meeting will be a virtual meeting, conducted solely via webcast. You will be able to participate in the virtual meeting online, vote your shares electronically, and submit live questions by visiting www.virtualshareholdermeeting.com/RJF2022. complementary businesses.

We are

also making use of the SEC’s “notice and access” rules, which allow companies to furnishonce again delivering proxy materials to

theircertain shareholders over the Internet.

We believe that this process expedites affected shareholders’ receipt of our proxy materials and lowers the costs—and reduces the environmental impact—of our Annual Meeting. Accordingly, we mailed to certain shareholders aThe Notice of Internet Availability of Proxy Materials

(“Notice”("Notice")

. The Notice contains instructions on how to access our Proxy Statement, Annual Report and other soliciting materials, and on how to vote. The Notice also contains instructions on how

you canto request paper copies of these materials if you so desire.

During the meeting, we will consider the proposals described in this Proxy Statement, and I will provide updates on our performance and progress on strategic initiatives. Your vote is very important to us. Whether or not you plan to participate in the virtual-only meeting directly, we ask that your shares be represented and voted.

On behalf of the Board of Directors and the management of Raymond James, I extend our appreciation for your continued support.

Yours sincerely,

Paul C. Reilly

Chairman and Chief Executive Officer

Notice of 2022 Annual Meeting of Shareholders

| | | | | |

DATE: | Paul C. Reilly Chair and Chief

Executive Officer |

| Thursday, February 24, 2022 |

| | | |

TIME:2023 PROXY STATEMENT | 3 |

January 11, 2023

Dear Fellow Shareholder,

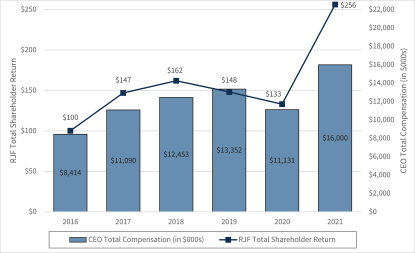

It was another highly successful and eventful year for Raymond James Financial. Your company delivered value to our shareholders through several accomplishments over the fiscal year, including: record annual net revenues of $11 billion; record net revenues in our Private Client Group, Asset Management and Bank segments and record pre-tax income in the Private Client Group; strong earnings growth; and achieving a17.0% return on common equity and 18.2% adjusted return on common equity. And we accomplished this as we also returned $437 million to shareholders through common stock dividends and share repurchases, successfully completed acquisitions of Charles Stanley Group PLC, TriState Capital Holdings, Inc., and SumRidge Partners, LLC, and all while maintaining a strong capital position with total capital to risk-weighted assets of 20.4%, well above regulatory requirements.

We also ensured that our company maintained the highest standards of integrity, transparency and culture of clients first, while ensuring our associates have an open, welcoming and diverse workplace in which each person has the opportunity to excel. Your board restructured our board committees, separating our Corporate Governance, Nominating and Compensation Committee into two separate committees—the Compensation and Talent Committee and the Corporate Governance and ESG Committee—defining even more robustly our commitment to all of our stakeholders in order to provide oversight and effectiveness at the board level and long term financial sustainability to our shareholders.

Upon completion of my tenure as both a director and as Lead Director of this incredible organization for the past six years, I would like to reflect on the priorities this company has demonstrated to me personally and indeed to all of us as shareholders.

First and foremost, this company lives its values, every day. They permeate the organization in all decisions, large and small. All decisions made by your board are consistent with the values this company has held since its founding and growth under both Tom James and Paul Reilly. Second, this company always reflects a “client-first” mindset and a commitment to its associates and the advisors who serve those clients, with a focus on independence and what is in the clients’ best interests.

As a new director during the financial crisis in 2008-2010, I saw firsthand the CEO and board do what was in the clients’ best interest for long-term financial sustainability, and that continued to what I witnessed during the COVID-19 period and all years in between. This company has always looked to the long-term regarding the needs of associates, clients, regulators, communities and investors.

So, it is with both joy and sadness that I complete my service on the board. Sadness in leaving the exciting, interesting and dynamic board and company of which I have been so honored to be a part. Joy in that I know what an amazing, committed and talented group of people lead this company—from the financial advisors and front-line associates to the Executive Committee and Board of Directors. I have seen our values consistently demonstrated from the very top, as Paul Reilly continues his exceptional leadership of this great company as CEO and Chair, and as the legend of Tom James continues as a member of the board.

And I know that Jeff Edwards, our new Lead Director, will be a strong voice of independent leadership for your board. With his tremendous experience in and knowledge of the financial services industry, along with his vast skillset and talents, he will partner with Chair Paul Reilly to lead this incredible group of directors in a way that you can depend on to represent you and your expectations.

I look forward to continuing with you as a shareholder in one of the truly great companies!

Yours sincerely,

| 4:30 p.m. (EST) |

| | | |

PLACE: | Susan N. Story Lead Independent Director |

Notice of 2023 Annual Meeting of Shareholders

| | | | | | | | | | | |

Date and Time Thursday, February 23, 2023, 4:30 p.m. (EST) Place The meeting will be a virtual-only meeting, conducted exclusively via webcast at www.virtualshareholdermeeting.com/RJF2022RJF2023. There will not be a physical location for the meeting, andso you will not be able to attend the meeting in person. Shareholders will be able to attend, vote, and submit questions (both before, and during a portion of, the meeting) virtually. Record Date December 21, 2022 (“Record Date”) |

| |

AGENDA: | | Agenda The following proposals will be voted upon: 1.

| |

| Proposal 1: To elect the eleven (11)ten (10) director nominees named in the Proxy Statement 2.

| |

| Proposal 2: To hold an advisory vote on our executive compensation 3.

| |

| Proposal 3: To hold an advisory vote on the

frequency of advisory votes on

executive compensation | |

| Proposal 4: To approve the following amendments to our Articles of Incorporation:A. Increase the number of authorized shares;

B. Restate or revise certain provisions governing the capital stock of the company;Amended and

C. Make certain updates and improvements

4. Restated 2012 Stock Incentive Plan

| |

| Proposal 5: To ratify our independent registered public accounting firm for fiscal 20225. 2023

| |

| | Other: To act on any other business that may

properly come before the meeting | |

| | | | | | | | |

RECORD DATE: | | December 22, 2021 (“Record Date”)

|

Who Can Vote:

| | Vote Shareholders of record

on the Record Date |

| |

Who Can Attend: | | Attend All shareholders are invited to attend the Annual Meeting. To attend the meeting at www.virtual shareholdermeeting.com/RJF2022www.virtualshareholdermeeting. com/RJF2023, you must enter the control number on your Notice of Internet Availability of Proxy Materials (“Notice”), proxy card or voting instruction form. The virtual meeting room will open at 4:15 p.m. (EST). |

| |

Date of Mailing: | | Mailing A Notice or the Proxy Statement, 2021a 2022 Annual Report to Shareholders, and a form of proxy are first being sent to shareholders and participants in our Employee Stock Ownership Plan on or about January 12, 202211, 2023. |

Vote Recommendation: The Board of Directors recommends a vote “FOR” All Proposals

| | |

|

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to beBe Held on February 24, 2022: | | 23, 2023: The Proxy Statement, 2021the 2022 Annual Report to Shareholders and the form of proxy card are available online at

www.raymondjames.com/investor-relations/news-and-events/shareholders-meeting.shareholders-meeting. |

|

Whether or not you are able to attend the virtual Annual Meeting, please complete, sign and return your proxy card by mail, or vote via the Internet or the toll-free telephone number.

By Order of the Board of Directors,

Jonathan N. Santelli,

General Counsel and Secretary

January 11, 2023

| | |

| | By Order of the Board of Directors, |

| | Jonathan N. Santelli, General Counsel and Secretary |

January 12, 2022 | | |

Table of Contents

| | | | | | | | | | | | | | | | |

| 2023 PROXY STATEMENT | | | | | | | | Raymond James Financial, Inc. 2022 Proxy Statement | | | | | | | | i | 5 |

Table of Contents

| | | | | |

| | | 44 | |

Notice of 2023 Annual Meeting of Shareholders | |

| |

| |

| |

| |

| |

| Board Non-Executive Nominees - Composition and Skills | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Board Leadership Structure | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | |

ii6 | | | | | Raymond James Financial, Inc. 2022 Proxy Statement | | | | | | | | | | | | |

About Raymond James

We are a different kind of financial services firm. At a time when the business of investment advice was about telling, Raymond James

Financial, Inc. isstarted with asking. We asked clients about their needs, their concerns and their long-term goals. And more importantly, we listened, providing truly personalized guidance rooted in people-first service. Nearly 60 years after our founding, we are a

leading diversified financial servicespublicly traded, global company

providing private client group, capital markets, asset management, banking and other services to individuals, corporations and institutions. Our financial services activities include providing investment management services to retail and institutionalwith distinct business units that serve clients

merger & acquisition and advisory services, the underwriting, distribution, trading and brokerage of equity and debt securities,in all 50 states, Canada and the

sale of mutual fundsUnited Kingdom. Throughout that growth, we’ve remained true to the core values that made it possible – long-term planning, independence, integrity and

other investment products. We also provide corporate and retail banking services and trust services.client-first service.

Our missionis to help individuals, corporations and institutions achieve their unique goals, while also developing and supporting successful professionals, and helping our communities prosper. Our visionis to be a financial services firm as unique as the people we serve, transforming lives, businesses and communities through the power of personal relationships and professional advice. Among the keys to our success, our emphasis on putting the client first is at the core of our corporate values. We also believe in maintaining a conservative, long-term approach in our decision making. We believe

that this disciplined approach has helped us build a strong, stable financial services firm for clients, advisors, associates and shareholders.

At Raymond James, corporate responsibility is one way we live out our mission and values, as well as fulfill our vision. Corporate responsibility includes our commitment to:

nurturing an inclusive and diverse environment that unleashes the power of perspectives to drive exceptional results

giving back to the communities in which we live and work, both through charitable contributions and volunteerism

maintaining our longstanding commitment to strong corporate governance, rooted in a conservative approach for long-term stability, and

making sustainable business and operational decisions for the benefit of clients, our firm and our society.

Our focus on sustainability means keeping an eye on the big picture and operating our business for the long term. Raymond James believes it is our duty to be good stewards of our resources and help clients build wealth responsibly for the future, which we accomplish through a variety of initiatives including but not limited to:

offering a sustainable investment platform tailored to meet clients’ individual impact goals

financing our clients’ essential environmental and community-minded projects, such as alternative energy infrastructure and affordable housing, and

taking responsibility for preserving the natural world and limiting the negative consequences of climate change by working to reduce our environmental impact.

Under the oversight of our Board, senior management has taken a number of recent steps to strengthen formal governance and disclosure of environmental, social and governance (“ESG”) matters at Raymond James. In 2019, we hired a full-time Director of Corporate Responsibility to survey and coordinate a wide variety of ESG initiatives and activities. With the support of management across key company functions and business units, we reviewed opportunities to enhance ESG initiatives, including publishing an inaugural Corporate Responsibility Report in April 2021. In addition, the Board has approved a restructuring of its committees that is designed, in part, to enhance oversight of the company’s strategies, policies and programs with respect to ESG matters. Please see “Reorganization of Board Committees.”

| | | | | | | | | | | | | | | | | |

| | | | | |

| By the numbers* | | | Raymond James Financial, Inc. 2022 Proxy Statement | |

| | | | | | |

$1.09 trillion in total

client assets | 1Approximately 8,700 financial advisors | More than 2x required total

capital ratio | 139 consecutive

quarters of

profitability | S&P 500 &

Fortune 400 company | Strong issuer and senior long term debt credit ratings: A-/Stable Outlook (Fitch), A3/Stable Outlook (Moody’s), BBB+/Positive Outlook (S&P) |

| | | | | |

We are furnishing or making available this Proxy Statement

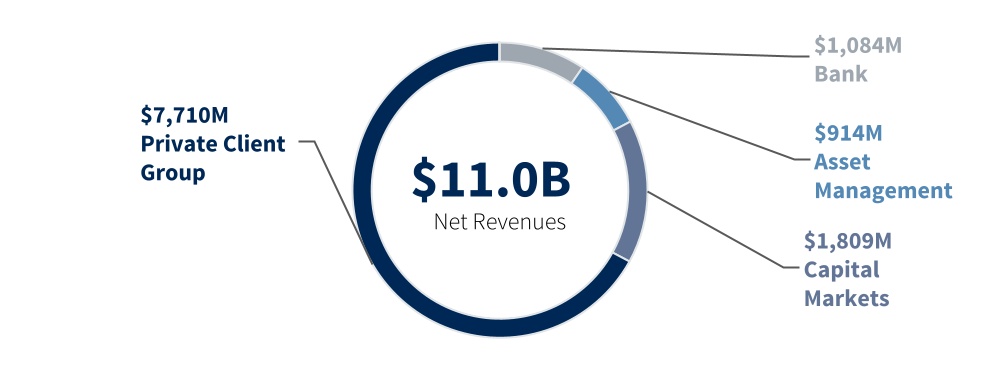

Diverse and Complementary Businesses**

Total net revenues of $11.0 billion for fiscal year ended

September 30, 2022

FY 2022

* As of September 30, 2022.

** Chart is intended to you in connection withshow relative contribution of each of the solicitationfirm’s four core business segments. Amounts do not add up to total net revenues due to “Other” segment and intersegment eliminations not being depicted. "Other" includes the firm’s private equity investments and interest income on certain corporate cash balances, as well as certain corporate overhead costs of proxies by the Company’s Board of Directors (“Board” or “Board of Directors”) for the virtual Annual Meeting of Shareholders to be held exclusively via webcast on February 24, 2022 (“Annual Meeting”). In this Proxy Statement, we may refer to Raymond James Financial, Inc.including the interest cost of our public debt, losses on extinguishment of debt, and certain acquisition-related expenses.

Growth Initiatives

| | | | | | | | | | | | | | |

| | | | |

| | | | |

Drive organic growth

across core businesses | | Expand investments

in technology | | Maintain disciplined focus on

strategic M&A |

2022 Performance Highlights

| | | | | | | | | | | |

| in millions, except per share amounts | 2022 | 2021 | % Change |

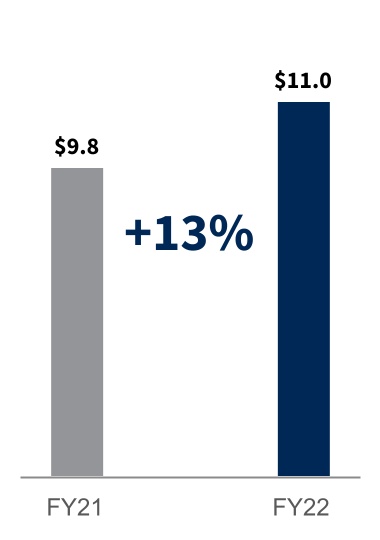

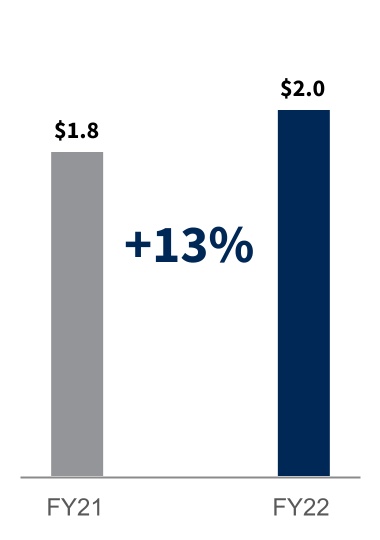

| Net Revenues | $11,003 | | $9,760 | | 13% |

| Net Income Available to Common Shareholders | $1,505 | | $1,403 | | 7% |

| Earnings per Common Share (Diluted) | $6.98 | | $6.63 | | 5% |

| Common Shareholders’ Equity Attributable to RJF | $9,338 | | $8,245 | | 13% |

Common Shares Outstanding(1) | 215.1 | 205.7 | 5% |

| Book Value per Share | $43.41 | | $40.08 | | 8% |

(1)Excludes non-vested Restricted Stock Units ("RSUs")

All Data as “Raymond James,” “RJF,”of Fiscal Year Ended September 30, 2022

•Record annual net revenues of $11.0 billion, an increase of 13% over fiscal 2021

•Record net revenues in Private Client Group, Asset Management and Bank segments and record pre-tax income in the “company,” “we,” “us”Private Client Group highlight the resilience of the business model and reinforce the value of our diverse and complementary businesses

•Record net income available to common shareholders of $1.51 billion, or “our.”$6.98 per diluted share; Record adjusted net income available to common shareholders of $1.62 billion

(1), or $7.49 per diluted share(1) •Return on common equity of 17.0% and adjusted return on common equity of 18.2%(1), both strong results, particularly given our robust capital position throughout fiscal 2022

•Completed acquisitions of Charles Stanley Group, TriState Capital Holdings, and SumRidge Partners

•Returned $437 million to shareholders through common stock dividends and share repurchases

•Maintained strong capital position with total capital to risk-weighted assets of 20.4%, well above regulatory requirements

(1)Adjusted net income available to common shareholders, adjusted earnings per diluted share, and adjusted return on common equity are each non-GAAP financial measures. Please refer to Appendix A for reconciliations of these measures to the most directly comparable GAAP measures and other important disclosures.

ESG Highlights

Through fiscal year 2022, we maintained focus on environmental, social and governance (ESG) opportunities as we sought to build a more sustainable future for clients, associates, advisors and the communities we serve. For additional information, please reference the 2022 Corporate GovernanceResponsibility Report which is available on our website.

Item 1. — Election of Directors

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| PEOPLE | | | | SUSTAINABILITY | | |

| | | | | | | | | | |

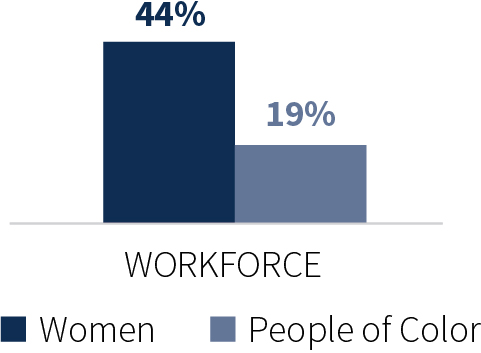

$975,000 Contributed to the Black community since 2021 On track to meet $1.5 million pledged over three years DIVERSITY METRICS* Launched the Veteran Financial Advisors Network *As of September 2022, reflective of how our U.S. associates self-identify | | | $14 billion in equity raised by Raymond James Affordable Housing Investments since inception in 1986 for housing finance authorities and housing developers, including nearly $1.4 billion in equity raised in fiscal year 2022 |

| | | | | |

| | Nearly 80% of Raymond James financial advisors utilize at least one sustainable investment fund with their clients | | |

| | | | | |

| |

Measured Scope 1 and Scope 2 greenhouse gas emissions, disclosed in our inaugural Task Force on Climate-Related Financial Disclosures (TCFD) |

| | | | | | | | | | |

| | | | | | | | | | |

| COMMUNITY | | | | GOVERNANCE | | |

| | | | | | | | | | |

| RAYMOND JAMES CARES MONTH | | | BOARD OF DIRECTORS** |

| | | | | | | | | | |

7,000 volunteer hours | | 120,000 people across 110 communities assisted | | | Split the Corporate Governance, Nominating and Compensation Committee into two committees: the Corporate Governance and ESG Committee and the Compensation and Talent Committee*** **This information pertains to our non-executive director nominees. ***As of 2/24/22 |

| | | | | | |

| $7.4 million raised in December 2022 through United Way | Proposal Snapshot — Item 1. Election of Directors

| | | | |

| | | | |

| | | | | | |

HURRICANE IAN RELIEF Firm and senior leadership donated over $800,000 in aid to impacted areas and relief organizations | | |

Proxy Summary

To help you review the proposals to be voted upon at our 2023 Annual Meeting, we have summarized important information in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should carefully read the entire Proxy Statement and our other proxy materials before voting.

| | | | | | | | | | | |

| | | |

| Proposal 1 | | |

| | | |

| Election of Directors | | |

| | | |

| | | |

| The Board recommends a vote FOReach director nominee. | | |

| | | |

Director Nominees

The following provides summary information about each director nominee.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Director

Since | Committee Membership |

| Name and Primary Occupation | Independent | Age | ARC | CG&ESG | C&T | CPC |

| Marlene Debel

Executive Vice President and Chief Risk Officer, MetLife, Inc. | | 56 | 2020 | | | | |

| Robert M. Dutkowsky

Former Chief Executive Officer and Executive Chairman,

Tech Data Corporation | | 68 | 2018 | | | | |

| Jeffrey N. Edwards

Chief Operating Officer, New Vernon Advisers, LP | | 61 | 2014 | | | | |

| Benjamin C. Esty

Professor of Business Administration, Harvard University Graduate

School of Business Administration | | 60 | 2014 | | | | |

| Anne Gates

Former President, MGA Entertainment, Inc. | | 63 | 2018 | | | | |

| Thomas A. James

Chair Emeritus and former Chief Executive Officer | | 80 | 1974 | | | | |

| Gordon L. Johnson

President, Highway Safety Devices, Inc. | | 65 | 2010 | | | | |

| Roderick C. McGeary

Former Chairman, Co-President and Co-Chief Executive Officer,

Tegile Systems, Inc. | | 72 | 2015 | | | | |

| Paul C. Reilly

Chair and Chief Executive Officer | | 68 | 2006 | | | | |

| Raj Seshadri

President, Data and Services, Mastercard Incorporated | | 57 | 2019 | | | | |

| | | | | |

| ARC | Audit and Risk Committee |

| CG&ESG | Corporate Governance and

ESG Committee |

| | | | | |

| C&T | Compensation and Talent

Committee |

| CPC | Capital Planning

Committee |

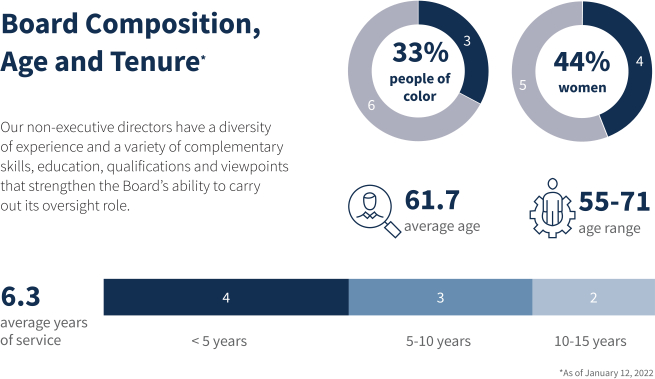

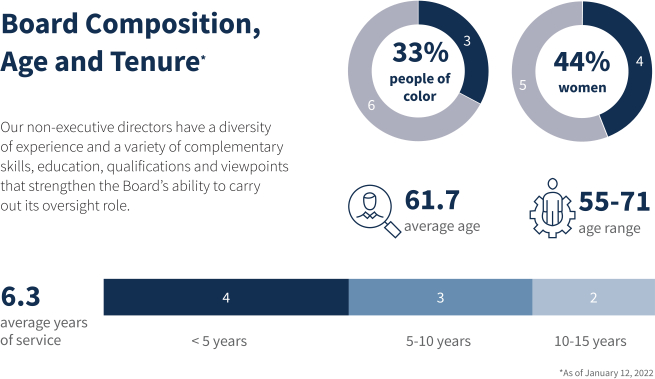

Non-Executive Board Nominees Snapshot

Our non-executive (i.e. non-employee) director nominees have a diversity of experience and a variety of complementary skills, education, qualification and viewpoints that strengthen the Board’s ability to carry out its oversight role.

<5 years

5-10 years

>10 years | | | | | |

| 6.4 average years of service |

Non-Executive Board Nominees Skills Matrix

The information below summarizes the range of selected qualifications and experiences that each non-executive director nominee brings to our Board.

| | | | | | | | | | | | | | | | | | | | |

| Non-Executive Director Nominee | Financial

Industry

Experience | Chair & CEO

Experience | Financial

Reporting | Corporate

Governance | Risk

Management | Technology |

| Marlene Debel | | | | | | |

| Robert M. Dutkowsky | | | | | | |

| Jeffrey N. Edwards | | | | | | |

| Benjamin C. Esty | | | | | | |

| Anne Gates | | | | | | |

| Gordon L. Johnson | | | | | | |

| Roderick C. McGeary | | | | | | |

| Raj Seshadri | | | | | | |

Governance Highlights

| | | | | |

| Board Independence and Qualifications | •Nine of our current 11 directors, and eight of our 10 director nominees, are non-executive directors who have been deemed independent under Securities and Exchange Commission ("SEC") and New York Stock Exchange ("NYSE") rules •All of our Board committees other than the CPC are composed exclusively of independent directors •Nominees to our Board may not serve on more than three (3) other public company boards |

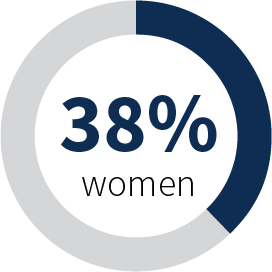

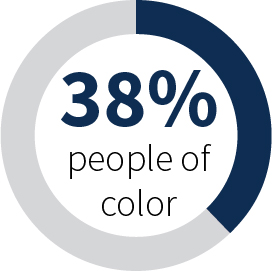

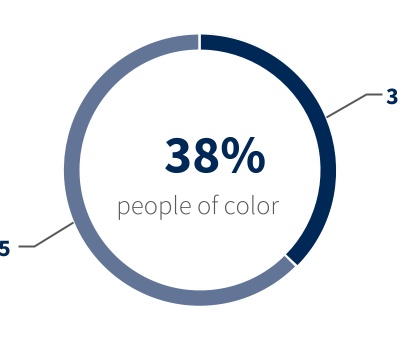

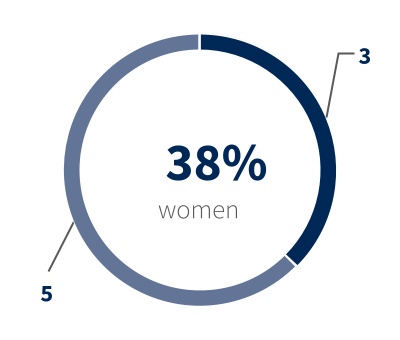

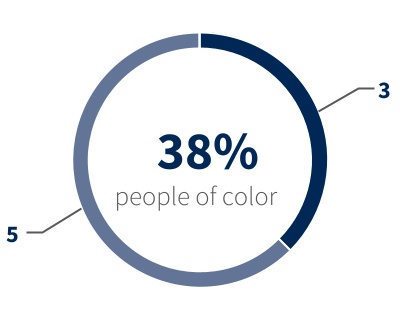

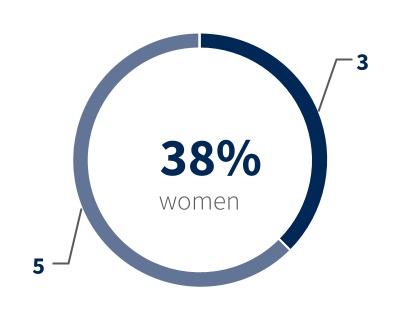

| Board Diversity and Refreshment | •38% of our non-executive director nominees are people of color •38% of our non-executive director nominees are women •Non-executive directors are normally expected to serve for no more than 12 years |

| Accountability | •Directors are elected for one-year terms •Directors must receive a majority vote of our shareholders to be re-elected •Special meetings of shareholders may be called by holders of 10% or more of our common shares •Our shareholders may act by written consent in lieu of a meeting •We do not maintain a shareholder rights plan, or “poison pill” •We maintain a Director Code of Conduct applicable to the Board •A robust compensation recoupment (“clawback”) policy applicable to executive officers, with triggers including materially imprudent judgment causing financial or reputational harm |

| Lead Independent Director | •A lead independent director, selected by our independent directors, operates pursuant to a separate written charter •Duties include presiding over executive sessions, recommending agenda topics, facilitating annual self-evaluation of Board and its committees, assisting in performance evaluation of our CEO, and CEO succession planning |

| Board Oversight of Risk Management | •Our Board exercises oversight of management’s responsibilities to assess and manage our key risks, including cybersecurity risks •The Board has delegated aspects of its oversight responsibility to its principal committees •The Board recently split its committees in order to further enhance subject matter oversight in certain focus areas |

| Board Practices | •Our Board and committees annually review their effectiveness with a questionnaire and confidential one-on-one interviews coordinated by the lead independent director, who reports on results in person to the Board •Evaluation includes review of individual director contributions to Board functioning by each other director •The Board continually adjusts its nomination criteria, with the goal that the Board continues to reflect an appropriate mix of skills and experience |

| Executive Sessions | •Non-executive directors hold executive sessions without management present at least four times per year •The lead independent director presides over these executive sessions •Each major Board committee generally holds executive sessions at regularly scheduled meetings |

| Share Ownership Requirements and Trading Limitations | •Robust stock ownership policy requires directors and executive officers to maintain meaningful ownership levels in our stock •Policy restricts trading by directors and executive officers and prohibits certain types of transactions, including use of options, short sales, hedging and pledging of our stock |

| | | | | | | | | | | |

| | |

| Proposal 2 Advisory Vote on Executive Compensation | |

| The Board recommends a vote FORthis proposal. | | |

| | | |

Overview

We are asking our shareholders to vote to approve, on an advisory (nonbinding) basis, the compensation of our named executive officers ("NEOs") as disclosed in this Proxy Statement in accordance with the SEC’s rules. This proposal, commonly known as a “say-on-pay” proposal, gives our shareholders the opportunity to express their views on our NEOs’ compensation.

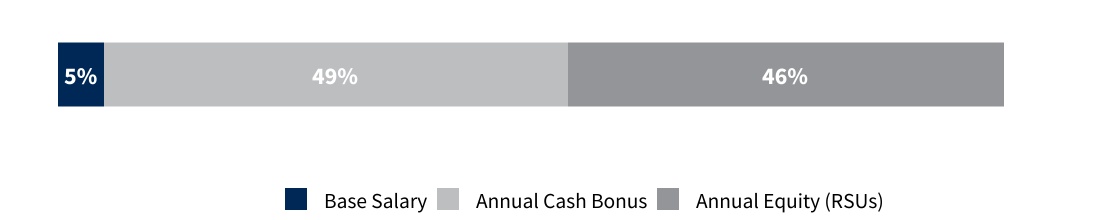

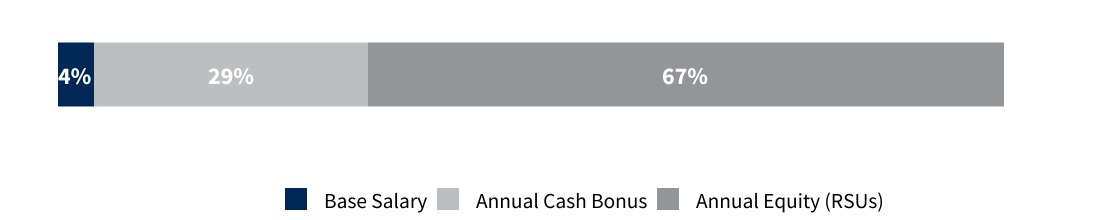

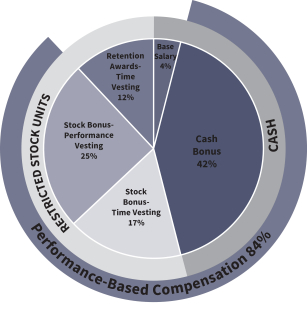

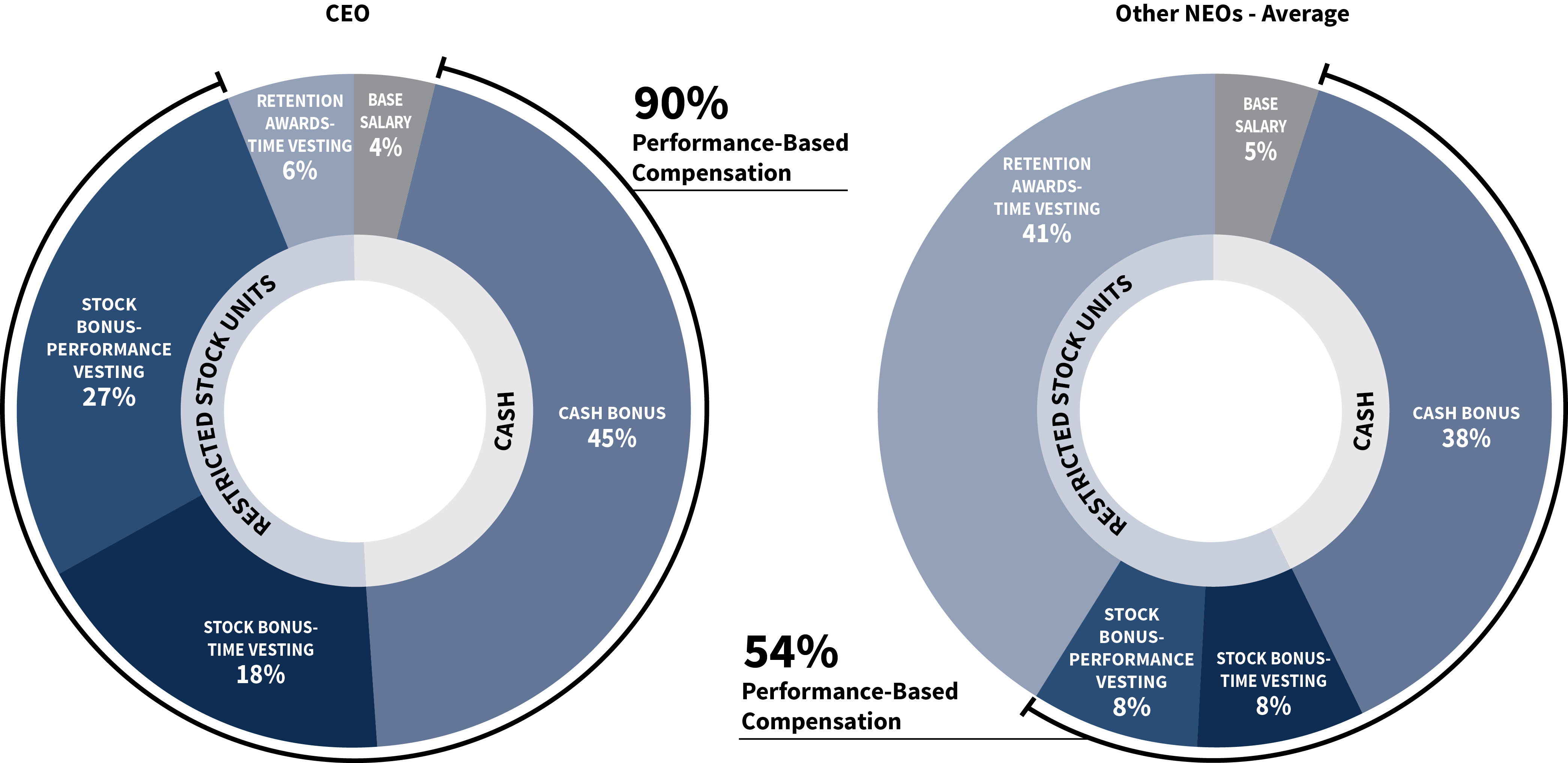

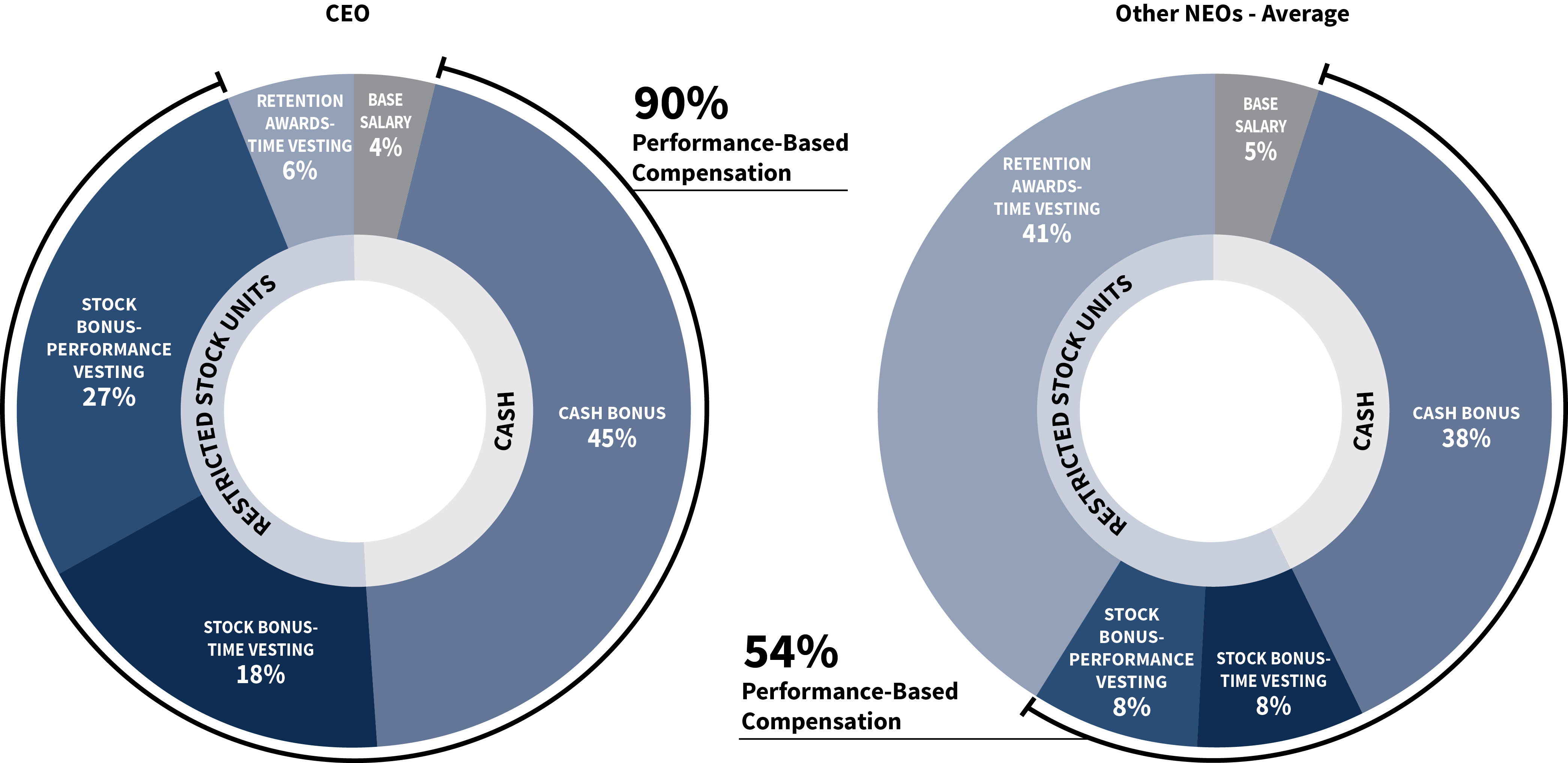

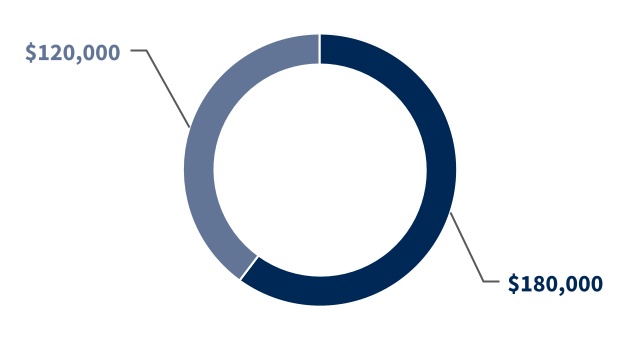

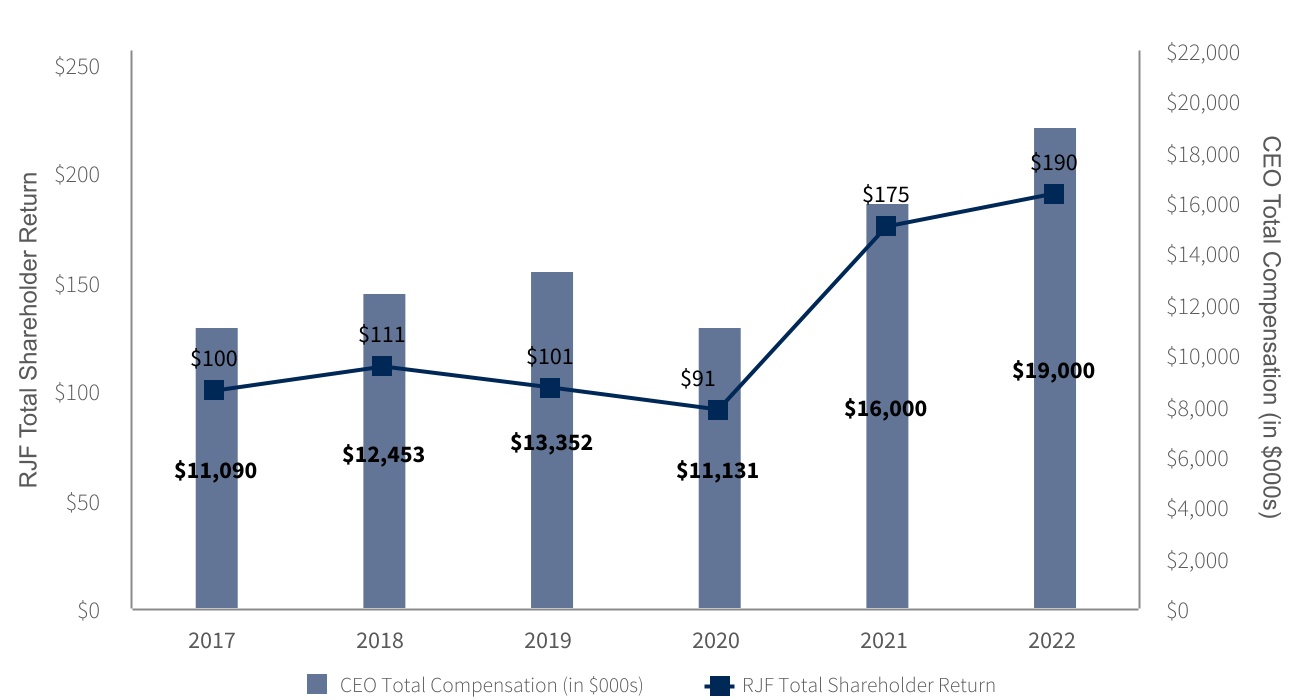

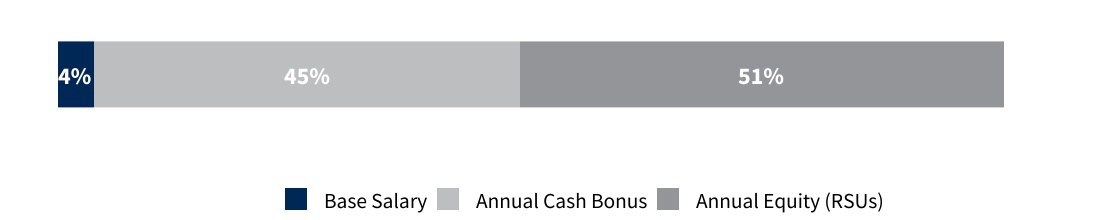

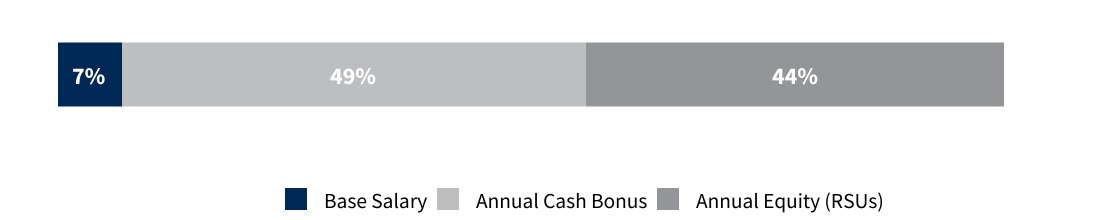

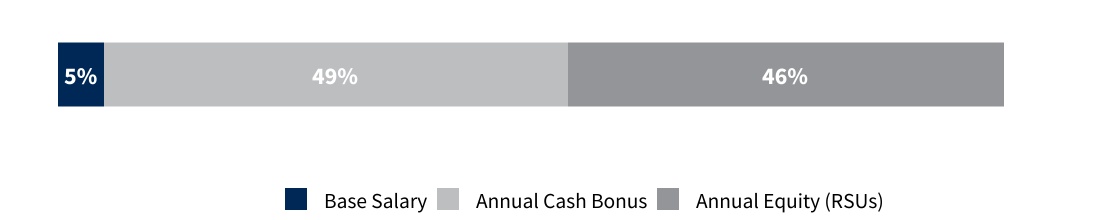

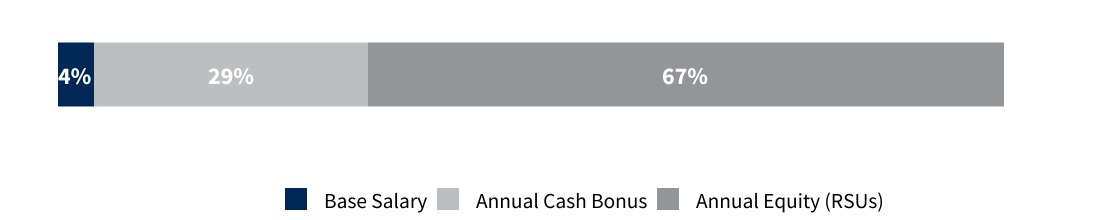

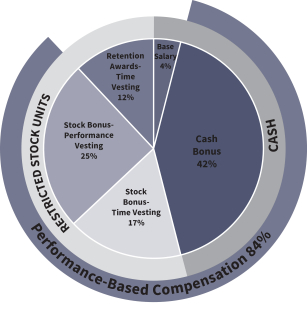

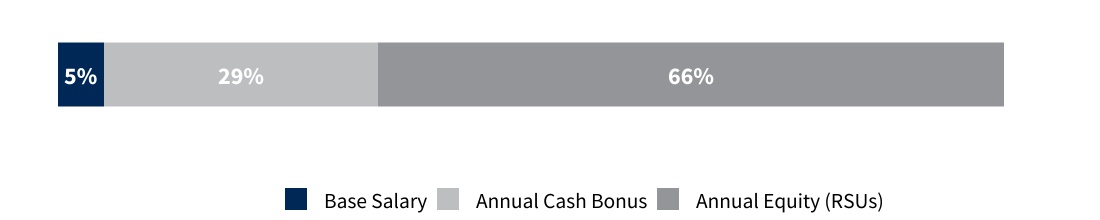

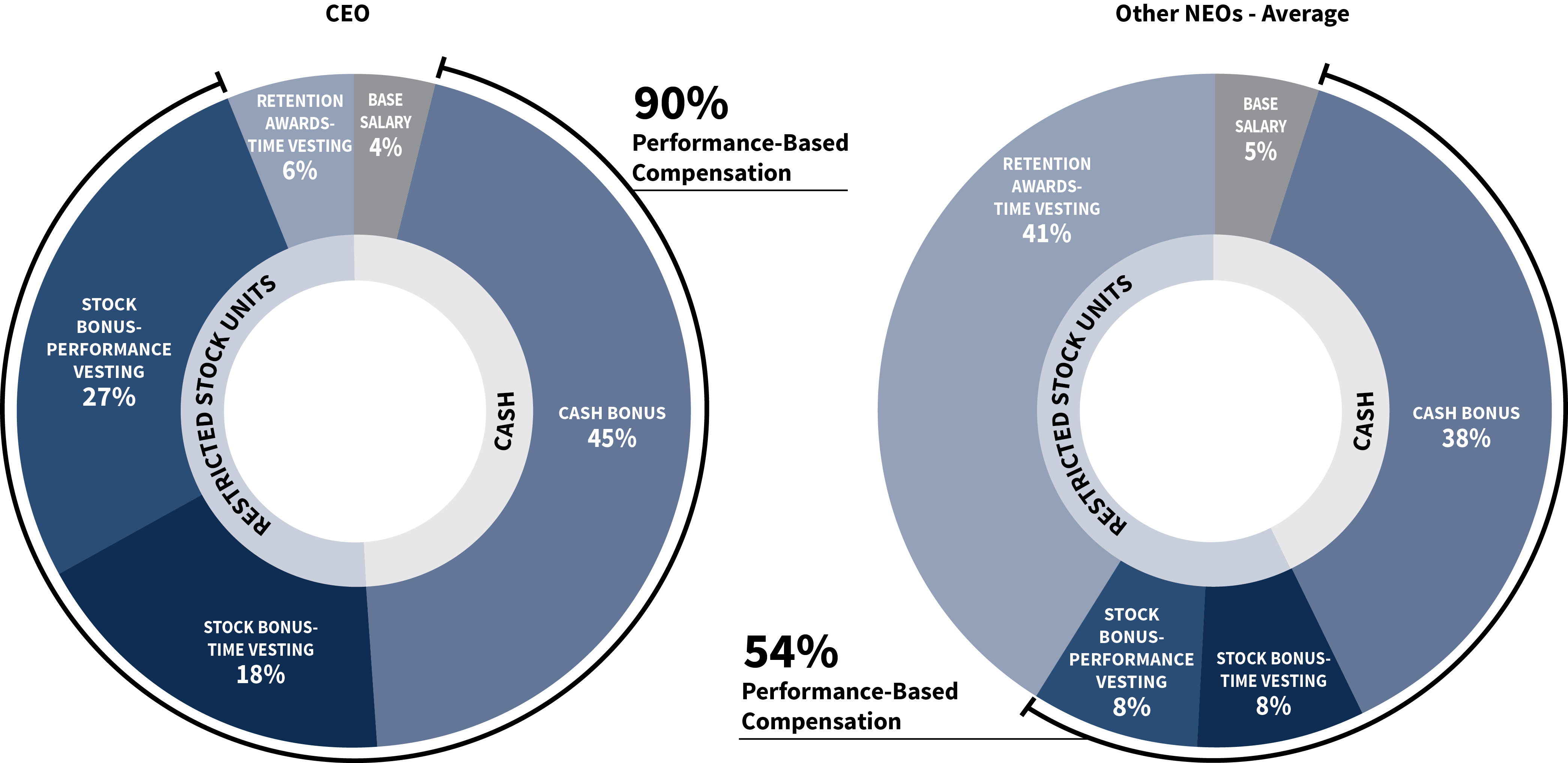

The following charts present the mix of compensation elements actually received for 2022 performance by our CEO and our other NEOs (average, excluding retirement plan contributions):

Components of Total Direct Compensation — 2022 Actual

| | | | | | | | | | | |

| Type | Pay Element | Purpose | Link to Strategy |

| Base Salary | •Provides base level of pay | •Competitive salaries attract and retain key talent |

| Annual Bonus - Cash | •Provides competitive incentive opportunity | •Rewards executives who achieve strategic and financial goals that are important for creating shareholder value •Attracts and retains key talent |

| Annual Bonus - Equity | •Aligns executives with shareholder interests •Time-vesting awards encourage retention by vesting at end of 3-year period •Performance vesting awards depend on company’s achievement of adjusted return on common equity ("Adjusted ROE")(1) and relative total shareholder return ("rTSR") thresholds, thus further aligning executives with long-term shareholder interests | •Time-vesting awards serve as a long-term retention tool •Performance-vesting awards encourage executives to focus on key financial metrics where final payout is dependent on company performance and stock price growth

|

| Retention Awards - RSUs | •Aligns executives with shareholder interests •Encourages retention by longer vesting period | •Serves as a long-term retention tool and further aligns our executives with our shareholders |

| Retirement Plan Contributions | •Profit Sharing, Employee Stock Ownership Plan ("ESOP") and Long-Term Incentive Plan ("LTIP") align executives with shareholder interests since contributions are based on company financial results. 401(k) Plan facilitates retirement savings. | •Provide competitive benefits package and further aligns executives with our shareholders |

(1)Adjusted ROE is a non-GAAP financial measure. Please refer to Appendix A for a reconciliation of this measure to the most directly comparable GAAP measure and other important disclosures.

Response to Say-on-Pay Vote

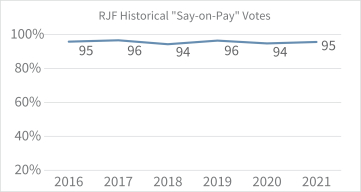

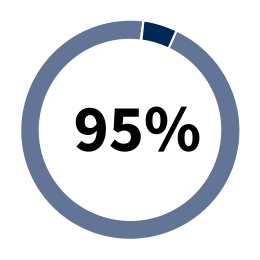

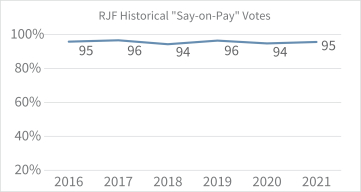

We hold an annual advisory vote by our shareholders on executive compensation. At the 2022 annual shareholders meeting, 95% of the votes cast were in favor of the “Say-on-Pay” proposal. We believe that the 2022 vote approving the Say-on-Pay proposal once again conveyed our shareholders’ strong support of the Compensation and Talent Committee’s decisions and our existing executive compensation programs. Based on this feedback, the committee determined to continue our current compensation practices as described herein.

% of votes in favor of

Say-on-Pay Proposal in 2022

Our Compensation Practices

| | | | | | | | | | | |

| | |

| Proposal 3 Advisory Vote on Frequency of Say-on-Pay Vote | |

| The Board recommends a vote for "every year" onthis proposal. | | |

| | |

We provide shareholders with the opportunity to vote, on a non-binding, advisory basis, for their preference as to how frequently they will provide advisory votes in the future on the compensation of our named executive officers. Shareholders may cast a vote on the preferred voting frequency by selecting the option of every year, every two years, or every three years (or abstain) when voting in response to the resolution. At the 2017 annual meeting, 88% of the shareholders expressed a preference for "every year."

| | | | | | | | | | | |

| | |

| Proposal 4 Approval of the Amended and Restated 2012 Stock Incentive Plan | |

| The Board recommends a vote FORthis proposal. | | |

| | |

Proposal

We are asking the company’s shareholders to approve an amendment and restatement of the company’s 2012 Stock Incentive Plan (the “2012 Plan”) as the Amended and Restated 2012 Stock Incentive Plan (the “A&R Plan”) in order to increase the maximum number of shares of the company’s common stock authorized for issuance over the term of the A&R Plan by 18,000,000 shares from 78,365,916 shares to 96,365,916 shares. The amendment and restatement would also extend the term of the A&R Plan to February 23, 2033, unless terminated earlier by the Board of Directors.

As of December 15, 2022 we have a total of 9,687,057 total outstanding awards, of which 9,360,207 are full value awards and 326,850 are options with the weighted average price of $53.81 and weighted average term of 2.099 years. In addition, as of December 15, 2022, 48,410,690 shares had been issued under the 2012 Plan, 80,983,051 shares were subject to options and other awards under the 2012 Plan and only 3,419,738 shares remained available for the grant of awards under the 2012 Plan. All other provisions of the 2012 Plan will remain in full force and effect under the A&R Plan.

Purpose of the A&R Plan

The purpose of the A&R Plan is to attract, motivate and retain our directors, employees and independent contractors and to provide an incentive to increase long-term shareholder value. We believe that equity is a key element of our compensation package and that equity awards encourage employee loyalty and align employee interests directly with those of our shareholders. The A&R Plan has allowed us to provide our employees with equity-based incentive awards and non-equity based compensation that are competitive with those of companies with which we compete for talent.

Purpose of Increasing the Number of Shares Reserved

The A&R Plan is our sole plan for providing equity incentive compensation to eligible directors, employees and independent contractors. The A&R Plan is a vital component of our compensation programs, and increasing the number of shares of common stock that may be issued under equity awards ensures that we have an adequate reserve of shares available for issuance in order to attract, motivate and retain personnel and to provide an incentive to increase long-term shareholder value. The Board believes that equity and cash awards motivate high levels of performance, align the interests of our personnel and shareholders by giving directors, employees and independent contractors the perspective of an “owner” with an equity stake in the company, and provide an effective means of recognizing their contributions to our success.

How the A&R Plan Is Designed to Protect Shareholder Interests

The Board has designed the A&R Plan to include terms that it believes reinforce the alignment between equity-based compensation arrangements and the interests of the company’s shareholders. Those terms generally provide for the following:

(1)Limits on terms of stock options and stock appreciation rights ("SARs"): The maximum term of stock options and stock appreciation rights that may be granted under the A&R Plan is seven years.

(2)No discounting: Stock options and stock appreciation rights must be granted with an exercise price no lower than fair market value on the grant date.

(3)No stock option or SAR re-pricing: The A&R Plan prohibits re-pricing of stock options or stock appreciation rights without shareholder approval, whether by amending an existing award agreement, substituting a new award at a lower price, or executing a buyout of the award for cash or securities.

(4)No “evergreen” provision: The A&R Plan does not permit an automatic increase in the shares available for issuance without shareholder approval.

(5)No liberal share recycling: The number of shares available for issuance under the A&R Plan will be reduced by the number of shares tendered or withheld in payment of an option exercise price, withheld from payment of an award in connection with tax withholding, or subject to a stock appreciation right but not issued in connection with the exercise of the stock appreciation right.

(6)Performance-based vesting of dividends and dividend-equivalent rights: Dividends or dividend-equivalent rights paid on performance vesting awards of restricted stock and RSUs may not vest unless the underlying awards vest.

Please see page 72 of this Proxy Statement for more information about the A&R Plan, including a summary of the material terms and conditions of the A&R Plan.

| | | | | | | | | | | |

| | |

| Proposal 5 Ratify Appointment of Independent Registered Public Accounting Firm | |

| The Board recommends a vote FORthis proposal. | | |

| | |

The ARC has appointed KPMG LLP as the independent registered public accounting firm to audit the company’s consolidated financial statements for the fiscal year ending September 30, 2023, and to audit the company’s internal control over financial reporting as of September 30, 2023. We are asking our shareholders to ratify this decision by the ARC.

Proposal 1 – Election of Directors

| | | | | |

|

What is being

voted on:Election

to our Board

of 1110 director

nominees. | Board recommendation:After a review of the individual qualifications and experience of each of our director nominees and his or her contributions to our Board, our Board determined unanimously to recommend that shareholders vote “FOR”“FOR” all of our director nominees. | |

|

The Board currently consists of eleven (11) directors. The Board has nominated the eleven (11)ten (10) directors identified below as candidates for election at the Annual Meeting. All nominees are current directors of the company and were unanimously recommended for re-election by the Corporate Governance Nominating and CompensationESG Committee (“CGN&C(the “CG&ESG Committee”). The Board continually monitors evolving board refreshment best practices, including those with respect to the average tenure of directors and the mix of both independentnon-executive and executive directors. In lightAfter 14 years of his long board tenure and in orderservice to keep an orderly transition, the Boardcompany, including 6 years as Lead Independent Director, Ms. Susan Story determined in consultation with Mr. Godbold, that heshe would not stand for re-election at the Annual Meeting. Mr. Godbold’s contributions to the

Board over his 44 yearsNon-Executive Nominees - Composition and Skills

Our non-executive director nominees have a diversity of serving as an executive director are substantial,experience and his knowledgea variety of complementary skills, education, qualification and insight about the Company over the fifty years in which he held leadership positions have added significant value.Director Independence

For a director to be considered independent under New York Stock Exchange (“NYSE”) rules, the Board must affirmatively determineviewpoints that the director does not have any “material relationship” with the company, either directly or as a partner, shareholder or officer of an organization that has a relationship with the company. A material relationship can include commercial, industrial, banking, consulting, legal, accounting, charitable and family relationships.

The Board has affirmatively determined that the following nine director candidates are independent under NYSE and U.S. Securities and Exchange Commission (“SEC”) rules: Marlene Debel, Robert M. Dutkowsky, Jeffrey N. Edwards, Benjamin C. Esty, Anne Gates, Gordon L. Johnson, Roderick C. McGeary, Raj Seshadri and Susan N. Story.

Each candidate has indicated that he or she would serve if elected. We do not anticipate that any nominee would be unable to stand for election, but if that were to happen, the Board may reduce the size of the Board, designate a substitute nominee or leave a vacancy unfilled. If a substitute is designated, proxies voting on the original director candidate will be cast for the substituted candidate.

| | | | | | | | | | | | | | | | |

2 | | | | | Raymond James Financial, Inc. 2022 Proxy Statement | | | | | | | | | | | | |

| | | | | | | | | | |

Marlene Debel, 55

Non-Executive Director

Director Since: 2020

RJF Committees

• Audit and Risk

Other Public Directorships

• Current: None

• Former (past 5 years): None

| | | | | | KEY EXPERIENCE AND QUALIFICATIONS

| | |

| | | | | |

| | | | | • Finance and risk management experience: Deep knowledge of finance and more than three decades of experience in financial, strategic and risk management

• Financial services management and leadership: Proven business leader who has helped guide organizations through periods of significant growth and change

|

| | | | | CAREER HIGHLIGHTS

• MetLife, Inc., a leading global provider of insurance, annuities, employee benefits and asset management services

• Executive Vice President and Chief Risk Officer (2019 – present)

• Executive Vice President and Head of Retirement & Income Solutions (2018 – 2019)

• Executive Vice President and Chief Financial Officer, U.S. Business (2016 – 2018)

• Executive Vice President and Treasurer (2011 – 2016)

• Global Head of Liquidity Risk Management and Rating Agency Relations, Bank of America (2009 – 2011)

• Assistant Treasurer, Merrill Lynch & Co., Inc. (2007-2008)

OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT

• Member, Board of Directors, Women’s Forum of New York

• Foundation Board Member, LaGuardia Community College

|

| | | | | | | | | | |

Robert M. Dutkowsky, 67

Non-Executive Director

Director Since: 2018

RJF Committees

• CGN&C

Other Public Directorships

• Current: U.S. Foods Holding Corp.; Pitney Bowes; The Hershey Company

• Former (past 5 years): Tech Data Corporation (2006-2020)

| | | | | | KEY EXPERIENCE AND QUALIFICATIONS

| | |

| | | | | |

| | | | | • Technology and technology risks: More than 40 years of experience in the information technology industry, including senior executive positions in sales, marketing and channel distribution with leading manufacturers and software publishers

• Corporate governance and leadership: Valuable governance perspectives from substantial senior executive leadership roles and experience as a board member and chair of several public and private companies

|

| | | | | CAREER HIGHLIGHTS

• Tech Data Corporation, a multinational IT products and services distribution company

• Executive Chairman (2017 – 2020)

• Chief Executive Officer (2006 – 2018)

• President, Chief Executive Officer, and Chairman, Egenera, Inc., a multinational cloud manager and data center infrastructure automation company (2004 – 2006)

• President, Chief Executive Officer and Chairman, J.D. Edwards & Co., Inc. an enterprise resource planning (ERP) software company (2002 – 2004)

• President, Chief Executive Officer and Chairman, GenRad, Inc., a manufacturer of electronic automatic test equipment and related software (2000 – 2002)

OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT

• Board of Directors, United Way Suncoast

• Board of Directors, First Tee of Tampa Bay

• Board of Directors, Moffitt Research Committee

• Advisory Board, University of South Florida Business School

• Board of Trustees, University of Tampa

|

| | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | Raymond James Financial, Inc. 2022 Proxy Statement | | | | | | | | 3 | |

| | | | | | | | | | |

Jeffrey N. Edwards, 60

Non-Executive Director

Director Since: 2014

RJF Committees

• CGN&C

• Securities Repurchase Committee

• Securities Offerings Committee

Other Public Directorships

• Current: American Water Works Company, Inc.

• Former (past 5 years): None

| | | | | | KEY EXPERIENCE AND QUALIFICATIONS

| | |

| | | | | |

| | | | | • Financial services industry: More than two decades of capital markets and corporate finance experience at a global financial services firm

• Review and preparation of financial statements: Experience as CFO of large financial services company provides valuable insights to our Board

|

| | | | | CAREER HIGHLIGHTS

• Chief Operating Officer, New Vernon Advisers, LP, a registered investment advisor (2009 – present)

• Merrill Lynch & Co., Inc., a global financial services company

• Vice Chairman (2007 – 2009)

• Chief Financial Officer (2005 – 2007)

• Head of Investment Banking for the Americas (2004 – 2005)

• Head of Global Capital Markets and Financing (2003 – 2005)

• Co-head of Global Equities (2001 – 2003)

OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT

• Director, The NASDAQ Stock Market (2004 – 2006)

• Director, Medusind, Inc., a medical billing company (2012 – 2019)

|

| | | | | | | | | | |

Benjamin C. Esty, 59

Non-Executive Director

Director Since: 2014

RJF Committees

• Audit and Risk (Chair since 2014)

Other Public Directorships

• Current: None

• Former (past 5 years): None

| | | | | | KEY EXPERIENCE AND QUALIFICATIONS

| | |

| | | | | |

| | | | | • Finance, investment and risk management: Extensive knowledge of finance and deep experience in the mutual fund/investment management business, including evaluation of fund performance, investment strategies, acquisition analysis, valuation analysis, trading, and risk management

• Financial services industry: Provides valuable insight to the company’s investment banking, commercial banking, and asset management businesses, as well as its own financing activities

• Executive leadership development: Experience in leadership development assists Board in oversight of management succession

|

| | | | | CAREER HIGHLIGHTS

• Harvard University Graduate School of Business Administration

• Professor of Business Administration teaching corporate finance, corporate strategy and leadership (1993 – present)

• Roy and Elizabeth Simmons Professor of Business Administration (with tenure, 2005 – present)

• Head of the Finance Department (2009 – 2014)

• Founding faculty Chairman, General Management Program (GMP), a comprehensive leadership program for senior executives

OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT

• Director and Chair of Audit and Risk Committee, Harvard Business Publishing Group, a not-for-profit education company

• Eaton Vance family of mutual funds

• Independent Trustee (2005 – 2013)

• Chairman, Portfolio Management Committee (2008 – 2013)

• Director, Harvard University Employees Credit Union (1995 – 2001)

• Member, Finance Committee

• Finance and Investment Committee, Deaconess Abundant Life Communities, a not-for-profit continuing care retirement community (2017 – present)

• Member of the Advisory Board, The GEM Group (2021 – present), a private seller of promotional products

|

| | | | | | | | | | | | | | | | |

4 | | | | | Raymond James Financial, Inc. 2022 Proxy Statement | | | | | | | | | | | | |

| | | | | | | | | | |

Anne Gates, 62

Non-Executive Director

Director Since: 2018

RJF Committees

• Audit and Risk

Other Public Directorships

• Current: The Kroger Company; Tapestry, Inc.

• Former (past 5 years): None

| | | | | | KEY EXPERIENCE AND QUALIFICATIONS

| | |

| | | | | |

| | | | | • Retail and consumer products insight: Over 25 years’ experience in retail and consumer products industry

• International business and growth markets: Broad business background in finance, marketing, strategy and business development, including growing international businesses

|

| | | | | CAREER HIGHLIGHTS

• President, MGA Entertainment, Inc., a developer, manufacturer and marketer of toy and entertainment products for children (2014 – 2017)

• The Walt Disney Company, a diversified multinational mass media and entertainment conglomerate (1991 – 2012)

• Executive Vice President, Chief Financial Officer—Disney Consumer Products (2000 – 2007, 2009 – 2012)

• Managing Director—Disney Consumer Products Europe and Emerging Markets (2007 – 2009)

• Senior Vice President of Operations, Planning and Analysis (1998 – 2000)

OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT

• Board of Directors, Cynosure (2020 – present)

• Board of Trustees, University of California, Berkley Foundation (2016 – present)

• Board of Directors, Salzburg Global Seminar (2018 – present)

• Board of Directors, CADRE

• Board of Trustees, PBS SoCal

• Board of Trustees, Packard Foundation (2020 – present)

• Board of Visitors, Columbia University Engineering School (2021 – present)

|

| | | | | | | | | | |

Thomas A. James, 79

Director – Chairman Emeritus

Director Since: 1970

RJF Committees

• Securities Repurchase Committee

• Securities Offerings Committee

Other Public Directorships

• Current: None

• Former (past 5 years): None

| | | | | | KEY EXPERIENCE AND QUALIFICATIONS

| | |

| | | | | |

| | | | | • Engaged and motivating leader who embodies our firm’s culture: Former Chairman and Chief Executive Officer of our company, with a unique understanding of our businesses and the financial services industry

• Entrepreneurial mindset: Perspective of an entrepreneur who led the growth of the company founded by his father

• Lifelong commitment: A deep, personal commitment to our company, exemplified by more than 50 years of service

• Shareholder advocate: His large stock ownership position ensures that his interests are strongly aligned with those of our other shareholders

|

| | | | | CAREER HIGHLIGHTS

• Raymond James Financial, Inc.

• Chairman Emeritus (2017 – present)

• Chairman of the Board (1983 – 2017)

• Chief Executive Officer (1970 – 2010)

OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT

• Financial Services Roundtable (2000 – present)

• Chairman (2007)

• Former Chairman, The Florida Council of 100

• Former Chairman, Securities Industry and Financial Markets Association (SIFMA)

• Certified Financial Planner (1978 – present)

• Member, Board of Trustees, The Salvador Dalí Museum (1987 – present)

• Founder and Chairman, The James Museum of Western and Wildlife Art (2018 – present)

• Chairman, Chi Chi Rodriguez Youth Foundation (2006 – present)

• Former Director, International Tennis Hall of Fame

|

| | | | | | | | | | | | | | | | |

| | | | | | | | Raymond James Financial, Inc. 2022 Proxy Statement | | | | | | | | 5 | |

| | | | | | | | | | |

Gordon L. Johnson, 64

Non-Executive Director

Director Since: 2010

RJF Committees

• CGN&C (Chair since 2018)

• Director of Raymond James Bank since 2007

Other Public Directorships

• Current: None

• Former (past 5 years): None

| | | | | | KEY EXPERIENCE AND QUALIFICATIONS

| | |

| | | | | |

| | | | | • Banking and financial services: Over 23 years of experience with unaffiliated banks

• RJ Bank insights: Fourteen years as a director of Raymond James Bank, a significant part of our business

• Entrepreneurial experience: Perspective of an entrepreneur and consumer of business-related financial services

|

| | | | | CAREER HIGHLIGHTS

• President, Highway Safety Devices, Inc., a full service specialty contractor (2004 – present)

• Bank of America Corporation, a multinational investment bank and financial services company

• Various managerial and executive positions (1992 – 2002)

OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT

• Director, Florida Transportation Builders Association (2007 – 2016)

• Director, Santa Fe Healthcare (2008 – 2014)

|

| | | | | | | | | | |

Roderick C. McGeary, 71

Non-Executive Director

Director Since: 2015

RJF Committees

• Audit and Risk

Other Public Directorships

• Current: Cisco Systems, Inc.; PACCAR Inc.

• Former (past 5 years): None

| | | | | | KEY EXPERIENCE AND QUALIFICATIONS

| | |

| | | | | |

| | | | | • Review and preparation of financial statements: Deep accounting and auditing knowledge acquired through many years with a large public accounting firm

• Leadership and governance: Decades of board and leadership experience involving multiple industries

• Technology and technology risks: Leadership experience with global technology companies

|

| | | | | CAREER HIGHLIGHTS

• Chairman, Tegile Systems, Inc., a manufacturer of flash storage arrays (2010 – 2012)

• BearingPoint, Inc., a multinational management and technology consulting firm

• Chairman (2004 – 2009)

• Interim Chief Executive Officer (2004 – 2005)

• Co-President and Co-Chief Executive Officer (1999 – 2000)

• Chief Executive Officer, Brience, Inc., a provider of software that enables companies to personalize customer experiences through broadband or wireless devices (2000 – 2002)

• Managing Director, KPMG Consulting LLC, a management consulting firm (April – June 2000)

• KPMG LLP, the U.S. member of a global network of professional firms providing audit, tax and advisory services

• Co-Vice Chairman of Consulting (1997 – 1999)

• Audit Partner for various technology clients (1980 – 1988)

OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT

• Certified Public Accountant

|

| | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | |

6 | | | | | Raymond James Financial, Inc. 2022 Proxy Statement | | | | | | | | | | | | |

| | | | | | | | | | |

Paul C. Reilly, 67

Chairman and Chief Executive Officer

Director Since: 2006

RJF Committees

• Securities Repurchase Committee

• Securities Offerings Committee

Other Public Directorships

• Current: None

• Former (past 5 years): None

| | | | | | KEY EXPERIENCE AND QUALIFICATIONS

| | |

| | | | | |

| | | | | • Strong leader, with prior public company CEO experience: Prior experience as chief executive officer of two complex, global organizations (one of which was a public company) brings a perspective to the Board beyond the financial services industry

• Auditing and strategic consulting perspective: Background as a CPA and financial services consultant

• Leadership continuity: Previous service on our Board provides continuity with prior senior management

|

| | | | | CAREER HIGHLIGHTS

• Raymond James Financial, Inc.

• Chairman (2017 – present)

• Chief Executive Officer (2010 – present)

• President (2009 – 2010)

• Non-executive Director (2006 – 2009)

• Chair, Audit Committee (2008 – 2009)

• Korn Ferry International, a global organizational consulting firm

• Executive Chairman (2007 – 2009)

• Chairman and Chief Executive Officer (2001 – 2007)

• Chief Executive Officer, KPMG International, a global network of professional firms providing audit, tax and advisory services(1998 – 2001)

• National Managing Partner, Financial Services, KPMG LLP, the U.S. member of a global network of professional firms providing audit, tax and advisory services (1995 – 1998)

OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT

• Member, Board at Large, Securities Industry and Financial Markets Association (SIFMA)

• Member, Board of Directors, American Securities Association

• Member, Board of Directors, National Leadership Roundtable

• Former Member, The Florida Council of 100

• Former Member, Financial Services Roundtable

• Former Director, United Way Suncoast

• Cabinet Member and former Chairman, Tampa Heart Walk and Heart Ball for the American Heart Association

• Member, The University of Notre Dame Business Advisory Council

• Trustee, House of Prayer Foundation

|

| | | | | | | | | | |

Raj Seshadri, 56

Non-Executive Director

Director Since: 2019

RJF Committees

• Audit and Risk

Other Public Directorships

• Current: None

• Former (past 5 years): None

| | | | | | KEY EXPERIENCE AND QUALIFICATIONS

| | |

| | | | | |

| | | | | • Financial services management: Brings to our Board a rare combination of skills and experience from her roles at global brands in marketing, sales, business strategy, asset management, wealth management, and business-to-business partnerships

|

| | | | | CAREER HIGHLIGHTS

• President, Data and Services, Mastercard Incorporated, a global payments and technology company (2020 – present)

• President, U.S. Issuers, Mastercard Incorporated, a global payments and technology company (2016 – 2020)

• BlackRock, Inc., a global asset manager

• Managing Director, Head of iShares Wealth Advisory (2014 – 2015)

• Managing Director, Global Chief Marketing Officer for iShares (2012 – 2013)

• Citigroup, Inc., a global financial institution

• Managing Director, Head of CitiBusiness for Citibank (2010 – 2012)

• Managing Director, Global Head of Strategy (2008 – 2009)

• Various positions at U.S. Trust Company, a private wealth advisory firm (2006 – 2008), McKinsey & Company, a global strategy consulting firm (1994 – 2006) and AT&T Bell Laboratories, a research and development organization (1992 – 1993)

OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT

• Trustee, Mount Holyoke College (2017 – present)

• Member, Global Board, American India Foundation (2019 – present)

• Member, Management Board, Stanford Graduate School of Business (2017 – 2020)

• Adjunct Professor, Columbia University Graduate School of Business (2012 – 2017)

• David Rockefeller Fellow (2017 – 2018)

|

| | | | | | | | | | | | | | | | |

| | | | | | | | Raymond James Financial, Inc. 2022 Proxy Statement | | | | | | | | 7 | |

| | | | | | | | | | |

Susan N. Story, 61

Lead Independent Director (since 2016)

Director Since: 2008

RJF Committees

• CGN&C

• Securities Repurchase Committee

• Securities Offerings Committee

Other Public Directorships

• Current: Dominion Energy, Inc.; Newmont Corporation

• Former (past 5 years): American Water Works Company, Inc. (2014 – 2020)

| | | | | | KEY EXPERIENCE AND QUALIFICATIONS

| | |

| | | | | |

| | | | | • Leadership and strategy: Leadership as former CEO of American Water Works Company, Inc., a $30 billion publicly traded company, has given her in-depth experience with addressing national economic challenges and regulatory and legislative issues

• Experience managing highly-regulated industries: An over six-year tenure as CEO (with prior experience as CFO) of the largest publicly-traded water and wastewater utility in the U.S., operating a highly-regulated utility business in 14 states and market-based businesses in 45 states, together with seven years as CEO of an electric utility in Florida, have provided extensive skills relating to interaction with state and federal regulators and managing complex organizations

• Technology, cyber security and human capital management: Extensive experience developing and implementing technological advances, including artificial intelligence (AI) and machine learning; overseeing critical infrastructure cyber security protocols and working with the Department of Homeland Security, Department of Defense and state FUSION agencies; recruiting, hiring and training an evolving workforce population as well as pioneering strategic workforce planning based on operational technology disruption; and mitigating rising employee healthcare costs through innovative partnerships and programs

|

| | | | | CAREER HIGHLIGHTS

• American Water Works Company, Inc., a U.S. publicly traded water and wastewater utility company

• President, Chief Executive Officer and director (2014 – 2020)

• Chief Financial Officer (2013 – 2014)

• The Southern Company, a U.S. regulated electric utility and natural gas distribution company

• Chief Executive Officer, Southern Company Services, Inc., Executive Vice President of Southern (2011 – 2013)

• President and Chief Executive Officer, Gulf Power Company, Inc. (2003 – 2010)

• Executive Vice President, Engineering and Construction (2001 – 2003)

• Senior Vice President of Southern Power Company (2001 – 2003)

OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT

• Board of Advisors, H. Lee Moffitt Cancer Center and Research Institute

• National Council of Chief Executives

• Advisor and founding member, NYSE Board Advisory Council

• Financial co-sponsor, with American Water Works Company, of $1 million partnership with the Jacki Joyner-Kersee Winning in Life® program to extend opportunities in economically distressed communities

|

| | | | | | | | | | | | | | | | |

8 | | | | | Raymond James Financial, Inc. 2022 Proxy Statement | | | | | | | | | | | | |

Board Structure and Governance Practices

Role of the Board

Raymond James’ business and affairs are managed under the direction of the Board of Directors. The role of the Board is to oversee management of the company in its efforts to enhance shareholder value and conduct the company’s business in accordance with its mission statement. In this vein,strengthen the Board’s duties include assisting management with assessing long-range strategies for the company and evaluating management performance.

Corporate Governance Principles

The Board has adopted Corporate Governance Principles, which are available in the Investor Relations section of the company’s website at www.raymondjames.com(the “company’s website”). This document describes the principles the Board follows with respectability to among other matters, the Board’s:

| | |

• role and duties

| | • size and composition

|

| |

• director responsibilities

| | • leadership structure

|

| |

• committees

| | • access to officers, employees and advisors

|

| |

• director compensation

| | • confidentiality

|

| |

• annual performance self-evaluation

| | • communications with shareholders

|

The Board’s Role in Risk Oversight

The Board exercises oversight responsibility with respect to management’s responsibilities to assess and manage our key risks, including market, credit, liquidity, operational, model, compliance, compensation and reputational risk. The Board has delegated aspects ofcarry out its oversight responsibility to each of the Audit and Risk Committee (“ARC”) and the CGN&C Committee.

The ARC is appointed by the Board to assist it in monitoring (i) the integrity of the company’s financial reporting, (ii) the independent accountants’ qualifications, independence and performance, (iii) the company’s systems of internal controls, (iv) the performance of the company’s Internal Audit Department, (v) the company’s Risk Governance Structure, and (vi) the company’s Compliance Risk Management Framework and compliance with legal and regulatory requirements.

The CGN&C Committee’s risk oversight role is to review management’s evaluation of the relationship between our compensation policies and practices and risks arising for the company, and to take steps to prevent such policies and practices from encouraging unnecessary or excessive risk-taking. The CGN&C Committee also takes any action necessary to help the company comply with rules and regulations relating to compensation programs and their relationship to risk management.

| | | | | | | | | | | | | | | | |

| | | | | | | | Raymond James Financial, Inc. 2022 Proxy Statement | | | | | | | | .9 | |

Board Composition and Skills

The Board currently consists of twelve (12) directors. The Board does not consider individual directors to be responsible for particular areas of the Board’s focus or specific categories of issues that may come before it. Rather, the Board seeks to assemble a group of directors that, as a whole, represents a mix of experiences and skills that allows appropriate deliberation on all issues that the Board might be likely to consider. The following information pertains to our non-executive directors:

director nominees:

<5 years

5-10 years

>10 years | | | | | |

| 6.4 average years of service |

Director Qualifications

The Board believes there are certain minimum qualifications that each director nominee must satisfy in order to be suitable for a position on the Board, including that such nominee:

•demonstrates high standards of integrity and character

•may not be on the boards of more than three (3) other public companies

•offers important perspectives on some aspect of the company’s business based on experience

•may not be subject to certain convictions or judgments of courts or regulatory authorities

Proposal 1 – Election of Directors

The table below summarizes the range of selected qualifications and experiences that each

non-executive director

nominee brings to our Board. The skills included in this table are evaluated against our strategy so that the table can serve as an

up-to-date tool for identifying

non-executive director nominees who collectively have the complementary experience and skills to guide the company. This summary is not intended to be a complete description of all of the skills and attributes possessed by each

director. | | | | | | | | | | | | | | | | |

| director nominee. 10

| | | | | Raymond James Financial, Inc. 2022 Proxy Statement | | | | | | | | | | | | |

Additional information about each Board member’s background, business experience and other matters, as well as a description of how each individual’s experience qualifies him or her to serve as a director, is provided abovebelow under the heading Item 1. – Election of Directors – Our Directors"Director Biographies".

| | | | | | | | | | | | |

| | | | | | |

| | Financial

Industry

Experience

| | Chair & CEO

Experience

| | Financial

Reporting

| | Corporate

Governance

| | Risk

Management

| | Technology |

| | | | | | |

Marlene Debel

| | ✓

| | | | ✓ | | | | ✓ | | |

| | | | | | |

Robert M. Dutkowsky

| | | | ✓ | | | | ✓ | | | | ✓ |

| | | | | | |

Jeffrey N. Edwards

| | ✓

| | | | ✓ | | | | ✓ | | |

| | | | | | |

Benjamin C. Esty

| | ✓

| | | | | | ✓ | | ✓ | | |

| | | | | | |

Anne Gates

| | | | | | ✓ | | | | | | |

| | | | | | |

Gordon L. Johnson

| | ✓

| | | | | | ✓ | | | | |

| | | | | | |

Roderick C. McGeary

| | | | ✓ | | ✓ | | ✓ | | | | ✓ |

| | | | | | |

Raj Seshadri

| | ✓

| | | | | | | | | | ✓ |

| | | | | | |

Susan N. Story

| | | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ |

Director Qualifications

The Board believes there are certain minimum qualifications that each director nominee must satisfy in order to be suitable for a position on the Board, including that such nominee:

| | |

• demonstrate high standards of integrity and character

| | • offer important perspectives on some aspect of the company’s business based on experience

|

| |

• may not be on the boards of more than three (3) other public companies

| | • may not be subject to certain convictions or judgments of courts or regulatory authorities

|

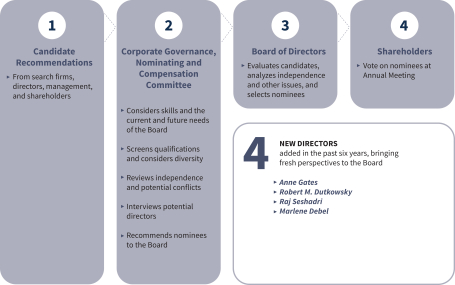

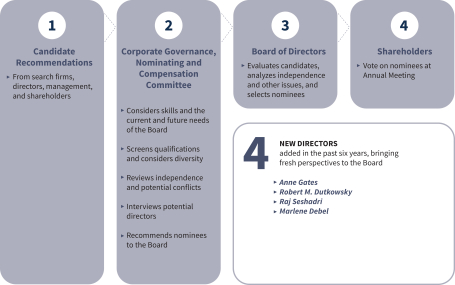

Nominating Process and Succession Planning

The CGN&C Committee reviews the experience and qualifications of all potential nominees to the Board. In considering director candidates, the CGN&C Committee generally assembles all information regarding a candidate’s background and qualifications, evaluates his or her mix of skills and qualifications and determines the contribution that the candidate could be expected to make to the overall functioning of the Board, giving due consideration to the Board balance of diversity of perspectives, backgrounds and experiences. The CGN&C Committee routinely considers diversity as a part of its deliberations, but does not have a formal policy regarding diversity. With respect to current directors, the CGN&C Committee annually evaluates the individual’s past participation in, and contributions to, the activities of the Board. The CGN&C Committee recommends director nominees to the Board based on its assessment of overall suitability to serve.

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Financial Industry Experience | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Chair & CEO Experience | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Financial Reporting | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Corporate Governance | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Risk Management | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Technology | | | | | | | | | | |

Proposal 1 – Election of Directors

Director Biographies

| | | | | | | | |

| |

| Marlene Debel, 56

Non-Executive Director |

|

Director Since:2020 RJF Committees •Audit and Risk •Capital Planning Committee | Other Public Directorships •Current: None •Former (past 5 years): None |

| | | | | |

Career Highlights •MetLife, Inc., a leading global provider of insurance, annuities, employee benefits and asset management services ▷Executive Vice President and Chief Risk Officer (2019 – present) ▷Executive Vice President and Head of Retirement & Income Solutions (2018 – 2019) ▷Executive Vice President and Chief Financial Officer, U.S. Business (2016 – 2018) ▷Executive Vice President and Treasurer (2011 – 2016) •Global Head of Liquidity Risk Management and Rating Agency Relations, Bank of America (2009 – 2011) •Assistant Treasurer, Merrill Lynch & Co., Inc. (2007 – 2008) | Other Professional Experience and Community Involvement •Foundation Board Member, LaGuardia Community College •Former Board Member, Women’s Forum of New York |

|

Key Experience and Qualifications •Finance and risk management experience:Deep knowledge of finance and more than three decades of experience in financial, strategic and risk management •Financial services management and leadership:Proven business leader who has helped guide organizations through periods of significant growth and change |

|

| | | | | | | | |

| |

| Robert M. Dutkowsky, 68

Non-Executive Director |

| |

Director Since:2018 RJF Committees •Compensation and Talent | Other Public Directorships •Current: U.S. Foods Holding Corp. (non-executive chair since January 5, 2023); Pitney Bowes; The Hershey Company •Former (past 5 years): Tech Data Corporation

(2006 – 2020) |

| | | | | |

Career Highlights •Tech Data Corporation, a multinational IT products and services distribution company ▷Executive Chairman (2017 – 2020) ▷Chief Executive Officer (2006 – 2018) •President, Chief Executive Officer, and Chairman, Egenera, Inc., a multinational cloud manager and data center infrastructure automation company (2004 – 2006) •President, Chief Executive Officer and Chairman, J.D. Edwards & Co., Inc., an enterprise resource planning (ERP) software company (2002 – 2004) •President, Chief Executive Officer and Chairman, GenRad, Inc., a manufacturer of electronic automatic test equipment and related software (2000 – 2002) | Other Professional Experience and Community Involvement •Board of Directors, First Tee of Tampa Bay •Board of Directors, Moffitt Research Committee •Advisory Board, University of South Florida Business School •Board of Trustees, University of Tampa |

| |

Key Experience and Qualifications •Technology and technology risks:More than 40 years of experience in the information technology industry, including senior executive positions in sales, marketing and channel distribution with leading manufacturers and software publishers •Corporate governance and leadership:Valuable governance perspectives from substantial senior executive leadership roles and experience as a board member and chair of several public and private companies |

| |

Proposal 1 – Election of Directors

| | | | | | | | |

| | |

| Jeffrey N. Edwards, 61

Non-Executive Director |

| |

Director Since:2014 RJF Committees •Corporate Governance and ESG •Compensation and Talent •Capital Planning Committee | Other Public Directorships •Current: American Water Works Company, Inc. •Former (past 5 years): None |

| | | | | |